As we have discussed in previous blogs, the method to calculate the presumed child support amount in Missouri Family Courts is dictated by Missouri Supreme Court Rule and through the use of the “Form 14”. Effective July 1, 2017 a new version of the Form 14 will take effect. In this blog we take a look at a couple of the major changes that could impact your Missouri child support.

As we have discussed in previous blogs, the method to calculate the presumed child support amount in Missouri Family Courts is dictated by Missouri Supreme Court Rule and through the use of the “Form 14”. Effective July 1, 2017 a new version of the Form 14 will take effect. In this blog we take a look at a couple of the major changes that could impact your Missouri child support.

Overnight custody adjustment

When calculating child support through the use of the Form 14, one of the significant factors impacting the amount of child support ordered is the number of overnight custody periods the paying parent is awarded in the family’s custody plan. In effect, the more time the children are in the physical custody of the paying parent the Form 14 adjusts, and the award of child support may be reduced. This adjustment is calculated on line 11 of the Form 14.

As it currently stands, the Court is granted a significant amount of discretion in determining what overnight credit (line 11 adjustment) to grant to the non-custodial parent for periods exceeding 109 overnights per year. For periods of custody which total fewer than 110 overnights per year, the current Form 14 dictates the applicable adjustment ( a 0 % to 10% adjustment depending on the specific number of days) to be used when calculating child support.

In instances where a custody order grants more than 109 overnights per year to the parent paying child support, your family court judge is granted wide discretion to establish his or her own percentage adjustment. For Missouri family law attorneys, the result can often be a wide range in the amount of child support ordered for different clients, based on the same set of circumstances. As custody awards generally move closer to a shared arrangement, with the number of overnights to the paying parent more frequently exceeding 109 per year, the line 11 adjustment the court grants can more frequently be a significant unknown variable when first trying to determine the likely child support award.

Under the new Form 14 that discretion is significantly reduced. The number of overnights per year beyond 109 overnights per year are now assigned a specific percentage (0% to 34%), thereby virtually eliminating this unknown variable. With this change, your family law attorney will be able to better advise you of the likely presumed amount of child support based upon your custody arrangement and the other relevant factors.

Lower income calculations

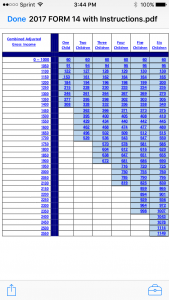

In addition to the change in custody adjustment, the Supreme Court has taken  steps to simplify the child support calculation process for what they are referring to as “lower income cases”. They have established a simple guideline for the amount of basic child support to be paid by a parent who make less than $16,800 per year, regardless of the number of children that he is supporting. The basic child support amount is simply based upon the monthly gross income of the paying and the number of children being supported. No other factors are considered.

steps to simplify the child support calculation process for what they are referring to as “lower income cases”. They have established a simple guideline for the amount of basic child support to be paid by a parent who make less than $16,800 per year, regardless of the number of children that he is supporting. The basic child support amount is simply based upon the monthly gross income of the paying and the number of children being supported. No other factors are considered.

As the number of children supported by the child support award increases, the income threshold for “lower income cases” also increases. Lower income calculation for families’ caps out for a parent earning $30,600.0 and paying child support for 6 children.

In circumstances where lower income calculations apply, child support will be the lesser of the child support amount should a full Form 14 be completed with all factors, including the receiving parent’s income, and the amount of basic support specified for lower income cases.

These are just a couple of the changes to calculating child support in Missouri that will be taking effect on July 1, 2017. If you have questions about child support calculations in Missouri or any family law matter, please contact our office today for a free consultation.

St. Charles Divorce Lawyer Blog

St. Charles Divorce Lawyer Blog